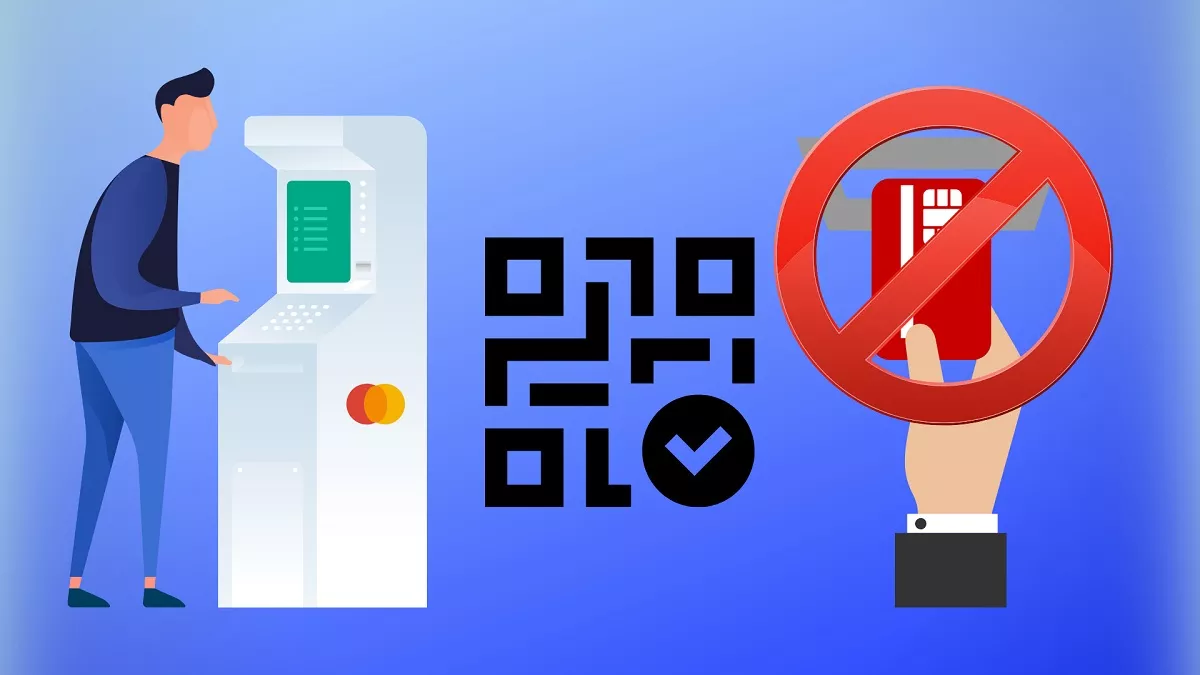

Contactless Cash Withdrawals At Indian ATMs: Here Is How It Will Work

Amidst the chaos created by the Coronavirus pandemic, Indian ATMs are testing a new feature that will allow users to withdraw cash without using an ATM card.

The step is being taken to avoid physical contact with an ATM, therefore mitigating the risk of virus transmission. As of now, AGS Transact Technologies Limited is providing a demo of cardless transactions at various ATMs, in collaboration with banks that have shown interest.

Reportedly, banks don’t need to install new ATMs to acquire the feature, but a software update which would activate cardless transactions.

How to withdraw cash without an ATM Card?

While the cash withdrawal method is under testing, here is how it will work –

- First, you will need to open the bank’s mobile app and tap on QR Cash Withdrawal.

- Now, enter the amount you want to withdraw and then scan the QR code on the ATM screen.

- Tap on the Proceed button after confirming the amount.

- Enter your mPIN.

- Collect the cash and the receipt

Is it secure?

Cardless transactions will be a more secure way to withdraw money as it will reduce the chances of card skimming. Moreover, a majority of people forget to take their ATM cards after a transaction. This problem will end with cardless transactions.

AGS Transact Technologies Limited has said that banks can enable cardless transaction facilities with minimum investments and without installing new ATMs. As of now, AGSTTL manages a network of 72,000ATMs in India in partnership with leading banks.